As with so many businesses, Navistar International has been impacted by the coronavirus pandemic, which is reflected in the company’s results for the second quarter of 2020, according to Troy A. Clarke, Navistar chairman, president and CEO.

Navistar today announced a Q2 net loss of $38 million, or $0.38 per diluted share, compared with a Q2 net loss of $48 million, or $0.48 per diluted share, in 2019.

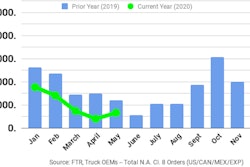

Revenues in the quarter were $1.9 billion, down 36 percent from second quarter 2019. The decrease was primarily driven by the impact of COVID-19, resulting in lower volumes in the company’s core (Class 6-8 trucks and buses in the United States and Canada) market, with chargeouts being down nearly 40 percent compared with the same period a year ago, the company reports.

Second quarter 2020 EBITDA was $61 million, compared with $55 million in Q2 2019. Adjusted EBITDA in Q2 2020 was $88 million versus $224 million a year ago. Adjusted net income for the quarter was a loss of $10 million compared with income of $105 million in the second quarter last year.

Navistar reports it finished the second quarter of this year with $1.5 billion in consolidated cash, cash equivalents and marketable securities, including $1.5 billion in manufacturing cash, cash equivalents and marketable securities.

“Our team has done a tremendous job managing the business throughout this challenging time and we have taken a number of steps to position the company to weather this crisis,” Clarke says.

During the quarter, the company says it took several actions to position itself in response to the global pandemic. In April, the company announced a series of actions to conserve more than $300 million of cash for the year without jeopardizing its strategic plans. The actions include savings from provisions of the CARES Act, postponing capital expenditures and spending and deferring the base salary of U.S. based exempt, non-represented employees. Also in April, the company completed the issuance of $600 million senior secured notes.

“We are focused on preserving cash and reducing cost, but not at the risk of sacrificing our future,” says Walter Borst, Navistar chief financial officer. “We remain steadfast in pursuing Navistar 4.0 and, while some programs and expenditures have been delayed, they have not been canceled. It’s important that we continue to invest in our company, even in these difficult times, to ensure our long-term success.”

Additionally, the company and its facilities have largely remained in operation throughout the quarter. Its production facilities have experienced limited disruptions that can be measured in weeks as opposed to months due mostly to supplier work stoppages. Its parts distribution centers have remained open throughout the quarter with only minor changes to hours of operation. The company’s dealer network also has continued to operate. In maintaining operation, the company has strictly followed CDC recommendations to prevent the spread of COVID-19, taking extensive measures to ensure the health and safety of its employees and their communities, the company says.

“As an essential business, we took early actions to protect our people so that we could fulfill our duty to keep our assembly plants running and parts distribution centers in operation to serve our customers and dealers who are keeping the economy moving by delivering essential goods and services to our communities,” says Persio Lisboa, chief operating officer.

“Throughout the quarter, we have worked closely with our suppliers to overcome significant disruptions to the flow of parts to our facilities and have been moderately successful in maintaining operations,” Lisboa says.

The company also took several actions to support its customers and trucking professionals. Working with its partners, the company provided meals, coupons and personal protective equipment such as masks and hand sanitizer to trucking professionals in need. For its customers, the company launched International Cares, which offered no payments for six months, free access to International 360 and worry-free vehicle service coverage.

“There are several theories as to the shape of economic recovery, but we have plans in place to respond accordingly,” says Clarke. “Recovery will likely be gradual as businesses reassess operating plans to return to a ‘new normal,’ but this ‘new normal’ will still require trucks. The actions we’ve taken over the past few months have us in position to succeed, no matter the shape of recovery.”

Truck segment

In the second quarter of 2020, the truck segment net sales were $1.4 billion, a decrease of $907 million compared with the second quarter of last year. The year-over-year decrease primarily is due to lower volumes in the company’s core markets attributable in part to the COVID-19 pandemic, lower Mexico volumes and a decrease in GM-branded units, the company says.

The truck segment incurred a net loss of $51 million in second quarter compared with a loss of $74 million in Q2 2019. The year-over-year improvement was due to a non-recurring EGR settlement charge of $159 million recorded in the second quarter of 2019, offset by the impact of lower volumes in the company’s core markets attributable, in part, to the COVID-19 pandemic, higher used truck losses and lower Mexico volumes in the second quarter 2020.

Parts segment

For the second quarter of 2020, the parts segment net sales were $443 million, a 23 percent decrease from Q2 2019. The decrease is primarily due to lower North America volumes due to the impact of COVID-19 and a decrease in Blue Diamond Parts (BDP) sales.

The parts segments saw a second quarter profit of $103 million, a 28 percent decrease from second quarter 2019. The decrease is primarily due to the impact of lower North America volumes related to COVID-19 and lower BDP sales, partially offset by lower intercompany access fees.

Financial services segment

In second quarter 2020, the financial services segment net revenues decreased to $64 million, a $14 million decrease from Q2 2019. The decrease was primarily driven by lower average finance receivables and a reduction in finance fees.

The financial services segment recorded a profit of $24 million in the quarter, an $8 million decrease from the second quarter of 2019. The decrease was primarily driven by lower revenues, partially offset by the results of an improved funding strategy.

For additional earnings information, CLICK HERE.