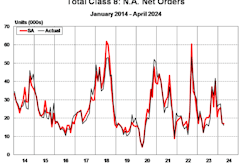

ACT Research's forward-looking indicators show the tractor outlook continues its downward trajectory for Q2, the company announced Friday.

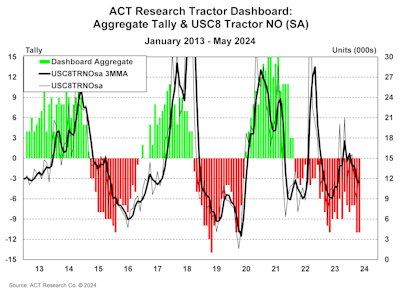

"Following a -7 reading in March, ACT's 15-metric Dashboard has posted back-to-back -11 readings, with negatives interspersed through the macro, freight and industry metrics that comprise the aggregate," says Kenny Vieth, ACT's president and senior analyst. "Were these 'nomal' times, the implied stepdown in support would be signaling increased tractor market weakness into next year. The wildcard as we look to 2025 is carriers' appetite to add equipment ahead of the EPA's expensive 2027 clean truck mandate."

In a webinar on Thursday, FTR Transportation Intelligence CEO Jonathan Starks said he doesn't expect a pre-buy to show in the market until late 2025 and early 2026. Vice President of Trucking Avery Vise said it is possible to see some fleets starting to think earlier about ordering new trucks.

"Mainly because, I think everyone realizes, if you wait until the last minute to order, you may not be able to get your truck," Vise says.

Veith says individual components of the heavy-duty market tend to be more closely synced and cycle together. With North American economies growing, he says robust U.S. and Canadian vocational markets are helping to offset any impending trough in tractor demand.

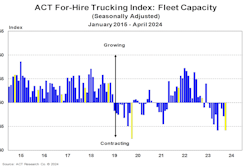

However, he cautions that any pockets of optimism are tempered by low for-hire carrier profits; no tractor market capacity rationalization, only additions; and excessive capacity expansion depressing freight rates.