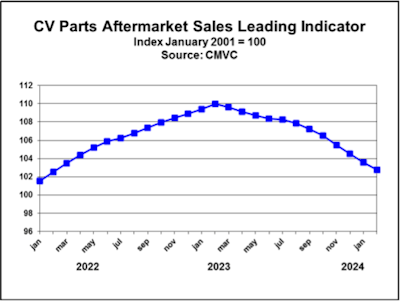

Aftermarket parts sales continue to scuffle, Commercial Motor Vehicle Consulting (CMVC) reported Wednesday, announcing its Parts Aftermarket Sales Leading Indicator (PLI) declined for the 12th month in a row in February.

The PLI was down 0.8% last month from January, which CMVC says signals lower parts aftermarket sales in the coming months excluding changes in parts prices.

“The process of rationalizing capacity in line haul applications is weighing on parts aftermarket sales as it is decreasing the number of trucks operating in line haul applications, increasing the supply of idled trucks on the used truck market and causing fleets to operate newer model year trucks on average as fleets place older trucks with more depreciation on the used truck market as they rationalize capacity,” says CMVC President Chris Brady.

[RELATED: Class 8 orders were down in March, experts report]

“Trucks in line haul applications make up a large share of Class 8 population and trucks in line haul applications generally depreciate at faster rates than trucks in local and regional applications, as line haul trucks generally operate at higher utilization rates than trucks in local and regional applications. The combination of these factors is weighing on parts aftermarket sales.”