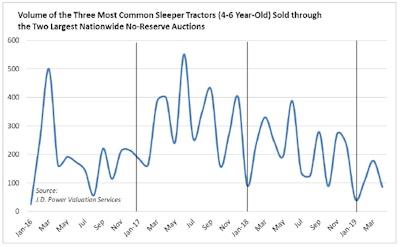

J.D. Power indicates in the auction market the volume of trucks sold last month “was down notably from March, while pricing was up by an equally notable amount. We had expected to see the opposite — a greater volume of trucks sold at somewhat lower pricing.”

The company’s benchmark model for April shows model year (MY) 2016 tractors averaged $43,920, $1,170 (2.7 percent) higher than March; MY 2015 tractors averaged $44,380, $7,780 (21.3 percent) higher than March; MY 2014 tractors averaged $32,178, $2,928 (10.0 percent) higher than March; MY 2013 tractors averaged $24,800, $600 (2.4 percent) lower than March; and MY 2012 tractors averaged $21,714, $2,964 (15.8 percent) higher than March.

J.D. Power reports low sales volume can cause unexpected results in its averages (particular with MY 2015), though the company states it was “still generally surprised by the higher pricing.”

For the first third of 2019, J.D. Power states 4- to 6-year-old trucks in its benchmark model brought 4.9 percent more money than in the same period of 2018. The low volume also reduced average depreciation for the year down below 1 percent per month.

“We still expect pricing to reach parity with 2018 and then turn mildly negative, but that shift is down the road,” J.D. Power says.

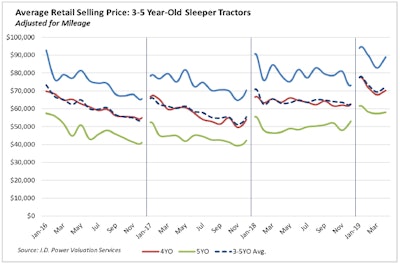

As with auction results, J.D. Power says retail pricing also surprised on the upside in April. Dealers sold a moderately lower number of trucks during the month but demand for trucks with average to low mileage is still outstripping supply.

In the 3- to 5-year-old cohort, J.D. Power says prices were as follows:

- MY 2017: $88,826; $6,022 (7.3 percent) higher than March

- MY 2016: $70,236; $2,328 (3.4 percent) higher than March

- MY 2015: $57,996; $664 (1.2 percent) higher than March

J.D. Power says when compared to 2018, those late-model tractors sold in the first three months of 2019 brought 11.7 percent more money than in the same period of 2018. April’s strong results also brought depreciation in the first four months of 2019 down to 1.9 percent per month, compared to 2.2 percent in the same period of 2018.

From a rooftop perspective, J.D. Power says Class 8 sales per dealership edged back down to 4.3 trucks in April, a 0.3 truck decrease compared to March, matching February’s result.

“Dealers are selling an average of 14.9 percent fewer trucks in 2019 compared to the same period of 2018,” J.D. Power says.

Finally, in the medium-duty space, the company says sales volume was generally higher in April while pricing was flat to down. Cabovers were essentially unchanged, Class 4 conventionals had an off month, and Class 6 conventionals fell back to February’s level after an unusually strong March.

Starting with Class 3-4 cabovers, J.D. Power says April’s average pricing came in at $14,658. This figure is $286 (1.9 percent) lower than March, and $250 (1.7 percent) higher than April 2018. For conventionals, Class 4’s averaged $17,779 in April. This figure is $2,145 (10.8 percent) lower than March, and $542 (3.1 percent) higher than April 2018. Class 6’s averaged $26,481 in April. This figure is $3,724 (12.3 percent) lower than March, and $6,918 (35.4 percent) higher than April 2018.

Overall, J.D. Power says trade disputes, not order volumes, will determine the immediate future in the used truck space.

“We will once again see a bump in freight volumes as manufacturers pull ahead imports in advance of tariff increases and expansion. This spike will be much shorter in term than the last one, but it means the industry will continue to need an elevated number of trucks in upcoming weeks.

The company adds, “Going forward, the health of the market depends largely on whether the trade war is resolved and tariffs are reduced or eliminated. A signed agreement would return predictability to the freight market and let fundamentals drive demand. The worst-case scenario is an agreement is not reached and tariffs remain in place longer-term. The macroeconomy would not be able to shrug off an impact of that magnitude, and the new and used truck markets would look dramatically different than they do now.”

For more information, and to read the entirety of this month’s report, please CLICK HERE.