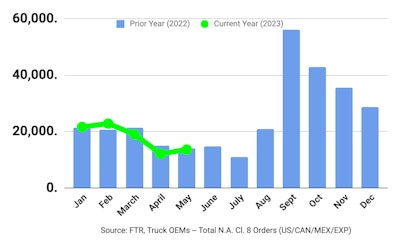

Class 8 truck orders bounced back from a tough April with a stronger May, ACT Research and FTR reported Friday in releasing their preliminary order reports.

ACT Research's May estimate of 15,500 units is up 29% from April and 10% higher year over year. FTR's preliminary Class 8 order total for May was lower at 13,600 units, but still up 9% from the prior month. FTR says that total was nearly in line with May 2022 and "above expectations" but below typical replacement demand. Total Class 8 orders for the past 12 months have equaled 298,700 units, FTR adds.

[RELATED: Industry suppliers unsure who to believe regarding 2024]

“Given robust Class 8 orders into year end and the ensuing backlog support, coupled with normal seasonal order patterns, orders were expected to moderate into Q2 and remain at relatively soft levels into mid-third quarter 2023. May orders were in line with this view,” says Eric Crawford, ACT Research vice president and senior analyst. “The relatively few build slots still free in the second half of 2023 suggest order intake is unlikely to find meaningful traction in the coming months.”

FTR Chairman Eric Starks adds, “With essentially all the build slots accounted for in 2023 and 2024 slots not yet open, a low level of activity in orders was no surprise. In fact, there was an expectation that the number could move below 10,000 units. Sub-10,000-unit order months are still possible over the summer. No surge in order activity would be expected until the OEMs open build slots for 2024, which would likely be August at the earliest.

He continues, “Fleet demand for equipment does not appear to be waning as they still want to take delivery of new equipment. Strong backlogs are keeping build demand strong, and FTR doesn’t anticipate any negative impact on build activity due to the recent order activity.”

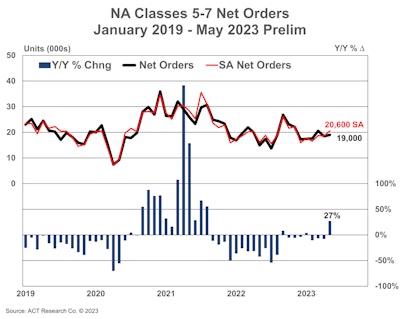

In the medium-duty market, orders were even stronger. ACT Research says its preliminary Class 5-7 order total for May was 19,000 units, up 3% from April and 27% year over year. Crawford says the strong total was a reverse of course after three straight months of decline. Seasonally adjusted, the total was even better at 20,600 units.