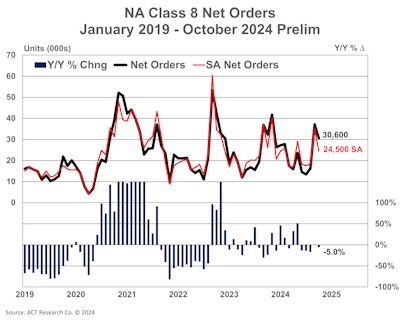

ACT Research and FTR's early October Class 8 truck order numbers show that despite a strong start to the 2025 order season in September, October numbers took a tumble.

In preliminary data released Monday, ACT says Class 8 orders were 30,600 units, down 5.2% year over year, while FTR reports a 14% month-over-month decrease to 28,300 units. Though up 2% over 2023, FTR says October's order total was still "somewhat short of seasonal expectations," as the average order total for the last seven years has been 33,940 units.

“After a strong start to the opening of 2025 order books in September, medium- and heavy-duty orders took a step back in October,” ACT Research President and Senior Analyst Kenny Vieth says. “On a seasonally adjusted basis, Class 8 orders fell 30% from September to 24,500 units, a 294,000 seasonally adjusted annual rate (SAAR).”

[RELATED: September truck orders see huge seasonal boost]

FTR adds that given the continued stagnation in the truck freight market, October's preliminary order total is still a good sign, but it does suggest some fleets are being cautious as they order for 2025. The company says orders in October "typically increase slightly from the prior month."

"This months, OEMs saw a drop month over month in total market demand, but there was inconsistency, as some experienced increases in orders and other saw declines," says Dan Moyer, FTR senior analyst for commercial vehicles. "The on-highway market showcased a notable jump in demand, softening the blow from the declines observed in the overall vocational sector."

FTR says year-to-date (YTD) performance remains at replacement demand levels with an average of 21,211 net orders per month, and YTD net orders in October were up 11% from 2023. North American Class 8 orders have now totaled 274,174 units for the last 12 months, the company says.

"Despite a sluggish freight market, fleets have sustained their investments in new equipment, albeit primarily at replacement demand levels thus far in 2024. We anticipate a slight uptick in October backlogs once the final Class 8 market data is released later this month. With inventory levels remaining close to record highs, we also foresee continued downward pressure on production rates through the remainder of 2024.”

ACT adds that medium-duty sales, previously remarkably consistent, also tumbled last month.

"Preliminary North America Classes 5-7 orders fell 5,800 units, or 27% year over year to 15,900 units," Vieth says, noting truck and bus backlogs are still high and warning that one month does not a trend make.