According to ACT Research’s latest release of its North American Commercial Vehicle Outlook report, expectations for the Class 8 and trailer markets anticipate an accelerating pullback in build rates, as freight market conditions remain at a low ebb.

While less cliff-like, ACT adds medium-duty market indicators continue to support a modest correction into 2020.

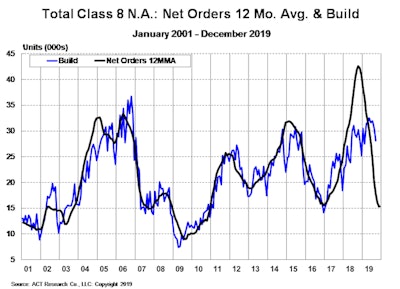

“They say a picture is worth 1,000 words, and one of our favorites is an overlay of the 12-month moving average of Class 8 net orders and actual production data,” says Steve Tam, ACT Research vice president. “As 20 years of history show, where the order trend goes, build follows, and positively, a turn in the 12-month moving order average can be seen as starting in December, meaning Class 8 orders in 2020 should handily outperform 2019. On the downside, we would note that every trough in the order average in the past 20 years has been met with a corresponding drop in builds.”

Class 8 truck orders hit a 12-month high in October but remain well below 2018 rates.

“Despite a high-side production surprise in September, large new inventories and deteriorating freight and rate conditions keep us cautious into the end of 2019,” Tam says.

As for the medium-duty markets, he adds, “Preliminary October net orders for this market segment slowed to their lowest level since July of 2016, and the drop appears to be a signal that medium-duty vehicle buyers are stepping back from the torrid pace of demand the space has enjoyed over the past year and a half.”