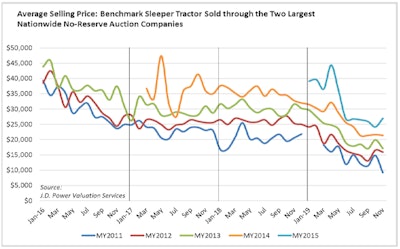

Within the auction space, the volume of 4- to 7-year-old trucks sold at auction was similar from October to November but price slipped almost across the board:

- Model year 2016: $30,750 average; $3,181 (9.4 percent) lower than October

- Model year 2015: $26.943 average; $2,772 (11.5 percent) higher than October

- Model year 2014: $21,366 average; $256 (1.2 percent) lower than October

- Model year 2013: $17,166 average; $2,775 (13.9 percent) lower than October

- Model year 2012: $15,950 average; $630 (3.8 percent) lower than October

- Model year 2011: $9,250 average; $5,593 (37.7 percent) lower than October

J.D. Power states during the first 11 months of the year trucks in its benchmark model have brought 12.3 percent less money than the same period last year. Yet in narrowing its comparison to just October and November, J.D. Power states trucks sold during those months brought 30.3 percent less than the same period in 2018.

Depreciation for 4- to 6-year-old trucks is averaging 3.4 percent. In the same period of last year, there had been essentially no depreciation. J.D. Power also notes pricing for late-model trucks is now mildly lower than the last market bottom in 2016.

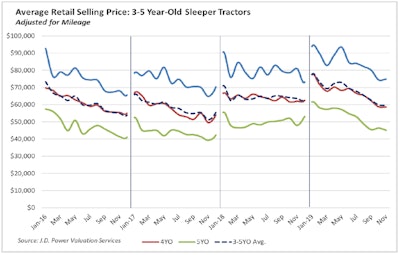

The retail market also saw little change month over month and was in line with J.D. Power’s expectations.

“On the bright side, low-mileage trucks remained strong,” the company says. “The only notable delta in the averages below is for model year 2018 trucks, which declined due to a combination of a higher-mileage mix of trucks sold and natural market movement.”

Looking at the popular 2- to 5-year-old truck cohort, November’s average prices were:

- Model year 2018: $95,102; $5,367 (5.3 percent) lower than October

- Model year 2017: $74,884; $508 (0.7 percent) lower than October

- Model year 2016: $58,633; $149 (0.3 percent) lower than October

- Model year 2015: $45,194; $1,221 (2.6 percent) higher than October

When looking at year-over-year performance, J.D. Power says the data shows two stories. Late-model trucks sold in the first 11 months of 2019 have averaged 5.4 percent more money than the same period last year. But, the company adds, “this positive result is due entirely to market strength in the first half of the year. Narrowing our focus to October and November 2019 versus October and November 2018, 2019 is running 6.5 percent behind.”

Depreciation thus far in 2019 has averaged 1.9 percent per month, compared to well under 1 percent in the same period of 2018. Pricing is now roughly on par with the last market bottom in 2016, J.D. Power says..

Additionally, dealers retailed an average of only 3.4 trucks per rooftop in November, the lowest figure in at least 11 years.

“Even during the last market downturn in 2015, this average stayed above 4,” J.D. Power says. “November is not typically a strong month for used truck sales, but conditions slowed down notably this fall.”

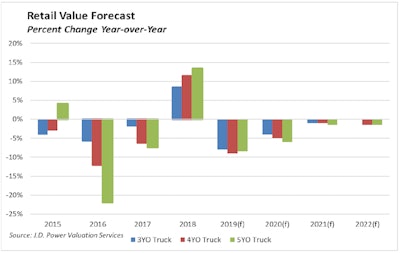

Concerns also abound for 2020, J.D. Power says.

“Macro estimates of global economic growth for 2020 have been mildly downgraded, a trend we expect to continue. Even with an apparent mild cooling off of the tariff war, there is still a long way to go on that front. Other headwinds include political turmoil in Western nations, ongoing renegotiation of trade agreements, and multiple nations’ efforts to onshore manufacturing.”

Looking ahead, the company notes fewer auctions on the calendar in the upcoming winter months will make it more difficult to identify developing pricing trends.

“We expect current conditions to be in place until late in the first quarter. At that point, we’ll have some sense of whether pricing has reached a bottom. Auction pricing will most likely bottom out before retail pricing. As we said in the forecast section above, economic strength will depend on whether general uncertainty improves or gets worse,” the company says.

For more information, and to read the entirety of this month’s report, please CLICK HERE.