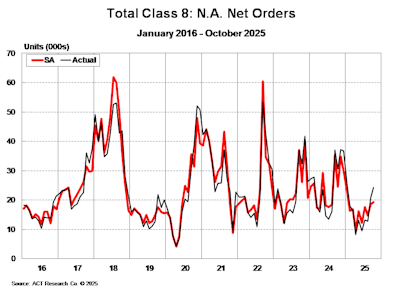

ACT Research reports final North American Class 8 net orders in October totaled 24,403 units, down 20% from 2024 but in line with the preliminary estimate from earlier this month.

“Class 8 tractor orders totaled 16,425 units, down 22% year over year. Vocational Class 8 orders totaled 7,978 units, down 16% year over year,” says Carter Vieth, research analyst at ACT Research. “Vocational, like the tractor market, continues to be affected in the short to medium term by policy fluctuations related to tariffs, federal funds and regulations. However, secular trends regarding utilities, roads, data centers, etc. remain positive for vocational in the long run.”

Vieth notes that vocational advantage when looking at how the current order season has begun, and what to expect as the year concludes.

[RELATED: Trailer orders enjoy needed seasonal spike in October]

“Ongoing weakness and uncertainty have muted activity at the start of peak order season. Data center growth, while extensive, is vocationally, not freight, intensive,” he says. “Key freight generators like manufacturing and housing remain sluggish or are in an outright downturn. On top of that, the payback period, following the freight pull-forward ahead of tariffs, has roosted in Q4, counterbalancing some of the current supply tightening.”

And Vieth adds the medium-duty orders has its own softness issues.

“Total Classes 5-7 orders fell 8.9% year over year to 15,833 units. Medium-duty orders have slowed notably this year, as still elevated inventories, a weaker economic outlook, and notably increased consumer pessimism weigh on medium-duty demand,” he says.