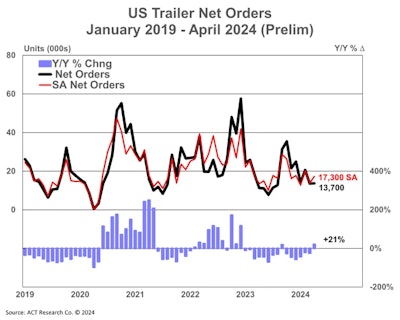

Trailer orders stabilized a bit in April, ACT Research and FTR report. Preliminary orders from ACT for last month were nominally changed from March at 13,700 units, but up more than 20% from April 2023. FTR tracked the month as up 9% from March to 13,016 units, and up 45% year over year.

FTR notes the order totals were still 20% below the average for the last 12 months, with the number of trailers ordered over the last 12 months increasing to just over 199,000 units. With a seasonal adjustment, ACT says April's total rises to 17,300 units.

“Against year-ago data, with pent-up demand beginning to wane and supply-chain congestion, for the most part, cleared, order activity continues to meet expectations,” says Jennifer McNealy, director, CV Market Research & Publications at ACT Research. “Despite the positive year-over-year comparison, net orders remain challenged by a backdrop of weak for-hire trucker profitability, albeit with some green shoots of improvement beginning to show.

[RELATED: Trailers see biggest shift in recent ACT equipment forecast]

FTR notes trailer production decreased by 3% month over month in April, totaling 22,975 units. Production was down 12% year over year. This build level aligns with the average April level over the past five years, the company adds.

“Anecdotal commentary from trailer manufacturers and suppliers through the past several months have indicated this slowing, as they have shared that orders are coming, but at a more tepid pace when compared to the last few years,” says McNealy.

FTR had a similar market analysis.

“With the truck freight market facing challenges, solid growth in April for both total van and major vocational trailer orders offers a few green shoots of optimism. Unless this growth continues in the coming quarters, decreasing backlogs and high dealer trailer inventory levels will put further downward pressure on trailer build rates,” says Dan Moyer, FTR"s senior analyst, commercial vehicles

McNealy adds ACT Research does see fleets starting to make more money later this year, thereby increasing their ability to purchase equipment on the horizon, but the impact likely will be muted for the trailer industry, “as we continue to expect their willingness to spend those available dollars will lean toward the purchase of new power units ahead of the EPA’s implementation of 2027 regulations, which we believe has already begun.”

She adds additional anecdotal information the firm has heard this month from those on the front lines of the trailer industry is that the ‘pause button’ is expected to remain pressed during this year of transition.

[RELATED: How the parts business has become an ever expanding frontier]

“The industry’s largest segments remain under pressure, cancellations are anticipated to continue their oscillation into and out of elevated territory as dealers and fleets recalibrate their inventory and immediate needs, and external forces like the U.S. and Mexican presidential elections and interest rates remain on the closely watched list,” the company says.

FTR also notes backlogs have fallen recently as orders continue to come in below production levels. In April, the backlog shed 5.060 units to end at slightly more than 147,000 units. FTR adds the decrease in backlogs would have been about twice as large if not for an OEM revision of backlogs that resulted in a roughly 5,000-unit increase for dry van and total backlogs.

With production and backlogs declining by a similar degree, FTR states there was no material change to the backlog-to-build ratio, which remains at 6.4 months. This ratio, which is slightly below the average level for the last half of 2023 but is above the historical average before 2020, currently indicates little overall incentive for trailer manufacturers to adjust production levels, the company says.