J.D. Power reported lower sales volumes and pricing at September auctions, it said Tuesday, which is unusual because September is usually the highest volume month in a year.

J.D. Power Valuation Services

J.D. Power Valuation Services

Benchmark pricing for late-model sleeper tractors was:

- 2021: $47,947; $1,239, or 2.5%, lower than August.

- 2020: $36,318; $2,7312, or 7%, lower than August.

- 2019: $24,096; $3,837, or 13.7%, lower than August.

- 2018: $17,934; $4,142, or 18.8%, lower than August.

Selling prices for four-to-six-year-old sleepers were 6.7% lower than August. Pricing is 1% lower than the pre-pandemic period of 2018 (21% lower if adjusted for inflation) and 46% higher than in late 2019 (19% higher if adjusted for inflation). Depreciation in 2024 is averaging 1.4% per month.

[RELATED: September data shows trailer orders remain low]

Retail sleepers dipped a little in September while daycabs stabilized. Overalll, the average sleeper sold in September was 63 months old and had 440,197 miles on it. It cost $59,549. Compared with August, September's sleeper was one month newer with 2.1% more miles and cost 2.9% more.

Average pricing in September for late-model trucks was:

- 2023: $118,402; $2,026, or 1.7%, lower than August.

- 2022: $90,593; $842, or 0.9%, higher than August.

- 2021: $61,681; $1,319, or 2.1%, lower than August.

- 2020: $48,595; $2,314, or 4.5%, lower than August.

- 2019: $38,189; $1,286, or 3.5%, higher than August.

- 2018: $25,920; $3,202, or 11%, lower than August.

Three-to-five-year-old sleepers brought slight less month in September — 1.4% less than August and 8.9% less than September 2023. Late-model sleepers are bringing 5% less money than 2019 (25% less when adjusted for inflation). Depreciation this year is averaging 2.3% per month, which J.D. Power says is historically typical.

[RELATED: Recession risks, market performance takes center stage at IMPACT Conference]

Daycabs sold retail brought even money to August, which is 16.3% less than September 2023. Price stability has improved int his sector, J.D. Power says, with an average depreciation improving to 3.6%. The company warns market dynamics in the auction channel look less positive, so there is no change to J.D. Power's outlook at present.

J.D. Power Valuation Services

J.D. Power Valuation Services

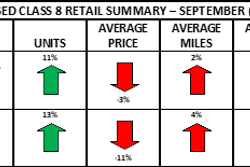

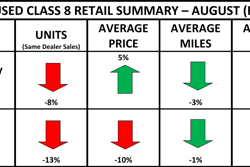

Dealers sold 2.4 trucks per rooftop in September, slightly higher (0.1%) in August. Overall, 11% more trucks were reported sold retail in September than in August.

For more information, and to read the entirety of this month’s report, please CLICK HERE.