Navistar President and CEO Mathias Carlbaum says the road to Class 8 truck electrification is uncertain. The destination is not.

Battery electric vehicles are going to be part of trucking’s future, Carlbaum told attendees Tuesday during the general assembly at the Truck Renting and Leasing Association (TRALA) Annual Meeting in Scottsdale, Ariz. Battery technology is improving rapidly. Infrastructure plans are in development. Total cost of ownership (TCO) parity compared to diesel for long haul operations will be achieved.

Carlbaum doesn’t know when that day will come, but at this point, he said the reality is too inevitable to ignore. Once a business case for BEVs is established, it won’t matter what regulations or public pressure started the industry down this path. Eventually the trucks are going to make business sense, and when they do, Carlbaum said fleets are going to want them.

[RELATED: Karl Rove gives history lesson, insights on upcoming election at TRALA Annual Meeting]

“There are 500 of us here and we all have an opinion [on electric trucks]. Most of us will be wrong,” Carlbaum said Tuesday. “Eight to 10 years from now, we will have a completely different ballgame than what we see right now.”

Carlbaum cited technological innovation in all facets surrounding BEVs as one reason for his (and Navistar and its parent company Traton Group's) growing confidence around an electric trucking future. Heavy vehicle battery technologies are being revolutionized as science and industry find new ways to reduce battery weights, improve life cycle and increase range, Carlbaum said. Similar developments are underway in regard to charging, and Carlbaum said he can see a not so distant future in which Class 8 sleeper trucks will be able to receive a complete charge in well under an hour. Coupled with a national charging network, Carlbaum said largest barriers to adoption of BEVs in the heavy truck space are aggressively being removed.

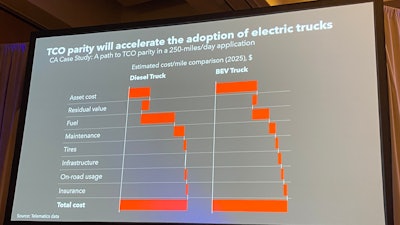

An example of how electric trucks could ultimately achieve price parity with diesel trucks in the coming years, presented by Carlbaum on Tuesday at TRALA's Annual Meeting.

An example of how electric trucks could ultimately achieve price parity with diesel trucks in the coming years, presented by Carlbaum on Tuesday at TRALA's Annual Meeting.

He added in some segments the technology is closing to making business sense already. Though the upfront price of BEVs still well exceed their diesel counterparts, Carlbaum said purchase incentives, reduced fuel/propulsion and maintenance costs can bring some BEVs in striking distance of ICEs, and cited yard trucks, waste haulers and other short-route applications as examples.

Additionally, as every aspect of the BEV ecosystem improves, Carlbaum said industry will ideally be able to reduce expenses a little bit in each area, which will bring TCO even closer to diesel trucks that will see their prices rise due to increased engine complexity due to regulation.

But Carlbaum also admitted Tuesday that diesel’s position as trucking’s default fuel isn’t going away. The EPA’s greenhouse gas regulations for 2027 to 2032 that were released last month require more zero-emission vehicle (ZEV) adoption by 2032 than first proposed, but are less strenuous for industry in 2027, ensuring diesel’s continued dominance in the short term. Carlbaum also said that while Class 8 long haul applications offer tremendous TCO savings for fleet owners in a fully realized BEV reality, that reality is still many years away, adding Navistar believes electrifying the truck fleet “is feasible to do over a 20- to 25-year period.”

[RELATED: Natural gas has promise, but not perfect alternative solution, NACFE reports]

In closing, Carlbaum stressed to the TRALA audience that while apprehension toward BEV adoption is reasonable, outright rejection of the technology would be unwise. Far too much money and innovation has been committed to the technology for it to be shelved, and even if regulations were to change, once TCO parity is achieved customer demand will exist.

“We need to do this step by step, side by side with you,” he said. “When this sector reaches TCO, it will benefit us all.”