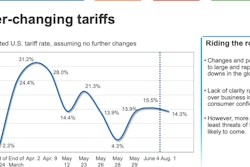

The effects of the highest tariffs since the 1930s on the freight market continue to put downward pressure on the trucking industry, ACT Research reported Friday in its Freight Forecast: Rate and Volume Report.

“Tariff impacts will be limited by the 75-80% of freight already made and consumed domestically, but the impacts on international trade have been and will continue to be significant,” says Tim Denoyer, ACT Research’s vice president and senior analyst. “Uncertainty may be starting to decline, but after pre-tariff inventory building in the first half, the paybacks from these pull-forwards will likely start soon, leading to a short and soft peak season.”

Denoyer says the trucking market has shown notable softness since Roadcheck in mid-May, with rate trends sliding and a brief jump in demand in early July already fading and freeing up capacity.

[RELATED: Truck tonnage dropped further in June]

“Capacity remained available even through the strongest seasonality of the year, partly because Class 8 tractor sales moved higher in Q2, counter to order trends, as the last pre-tariff vehicles were snapped up,” he says. “While freight demand headwinds remain, equipment sales are likely to decline as tariffs have begun. Soft used tractor day cab prices also suggest private fleets are starting to reverse course, suggesting tighter capacity ahead.”

Denoyer goes on, “Our Driver Availability Index started to tighten this month for the first time in over three years as well, and these supply factors should limit the downside for freight rates.”