ATD and NADA Chief Economist Patrick Manzi states sales were down across the board in the first half.

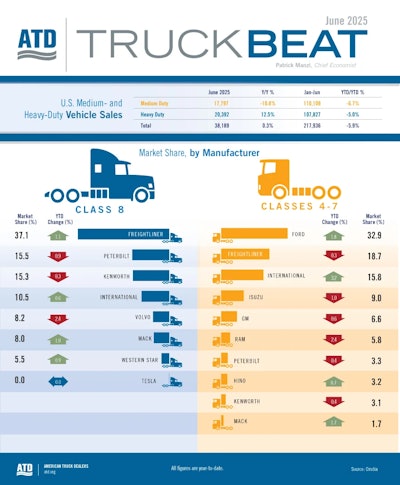

The Class 8 market, despite its 5% dip, still outpaced the medium-duty space where sales were down by 6.7%. Overall, Manzi reports commercial truck sales through June of 217,936 units, down 5.9% from 2024.

Weak order announcements don’t offer much help for the second half of the year or 2026 either. Manzi references recent TPS reporting from ACT Research and FTR that pegged last month as the weakest June since 2009, while lower carrier profits, excessive new truck inventory and tariff, regulatory and market uncertainty are putting increased strain on order potential for the months ahead.

The soft market also led to some minor changes in marketshare. Freightliner (up 1.1%), Mack (1.0%), Western Star (0.9%) and International (0.6%) gained marketshare in the Class 8 space; International (up 3.2%) and Ford (1.8%) were the big winners in the Classes 4-7 market.

“Orders will likely remain low throughout the summer until the excess Class 8 inventory is sold or there is a significant uptick in freight demand,” Manzi states.

Pricing will be a factor as well.

Manzi notes Volvo Trucks and Mack Trucks have already announced price increases due to steel and aluminum tariffs while many other tariffs could have long-term impacts on component pricing. He also notes the rapidly shifting tariff landscape makes it hard for dealers to offer price certainty beyond the short term, which could alter spending intentions.

[RELATED: Finalists named for 2025 Successful Dealer Award]

“Our outlook for commercial truck sales has been reduced significantly since the start of the year, with heavy-duty sales forecasts being trimmed by 30,000 units and our medium-duty forecast reduced by 24,000 units,” Manzi states. “Our full year sales outlook is 233,000 units for medium-duty trucks and 222,000 units for heavy-duty trucks.”

The good news, if there is any, is truck sales were down by 6.5% in the first quarter, so the industry did make back a tiny bit of its losses in April through June.