In the auction market, pricing of J.D. Power’s benchmark model was back down after an unusual April, with volume way up compared to recent months. May’s activity looked more logical than April’s given the market dynamics currently in effect, the report states.

- Model (MY) year 2016: $36,500 average; $7,420 (17.0 percent) lower than April

- MY 2015: $36,000 average; $8,380 (18.9 percent) lower than April

- MY 2014: $28,750 average; $3,428 (10.7 percent) lower than April

- MY 2013: $23,500 average; $1,300 (5.2 percent) lower than April

- MY 2012: $18,750 average; $2,964 (13.7 percent) lower than April

- MY 2011: $17,765 average; $1,730 (10.8 percent) higher than April

In the first five months of 2019, 4- to 6-year-old examples of the benchmark model brought 2.5 percent more money than in the same period of 2018, according to the report.

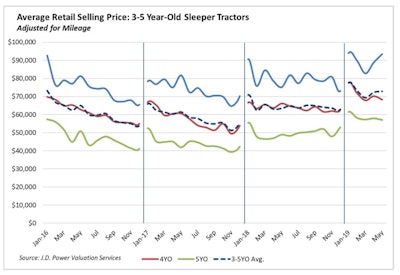

J.D. Power says the average sleeper tractor retailed in May was 69 months old, had 456,127 miles, and brought $57,613. Compared with April, the average sleeper was two months younger, had 12,103 (2.6 percent) fewer miles and brought $815 (1.4 percent) more money. Compared with May 2018, this average sleeper was one month older, had 7,950 (1.8 percent) more miles and brought $4,551 (8.6 percent) more money.

Trucks three to five years of age, May’s average pricing was as follows:

- MY 2017: $93,430; $4,604 (5.2 percent) higher than April

- MY 2016: $68,297; $1,939 (2.8 percent) lower than April

- MY 2015: $57,137; $532 (1.5 percent) lower than April

“Year-over-year, late-model trucks sold in the first five months of 2019 brought 12.3 percent more money than in the same period of 2018,” the report states.

J.D. Power says Class 8 sales per dealership dropped to 3.9 in May, a 0.4 truck decrease compared with April, and the first time the average has dropped below 4.0 since January. Dealers are selling an average of 10.6 percent fewer trucks in 2019 compared with the same period last year.

Medium-duty sales volume contracted in May, while pricing was mixed, according to J.D. Power.

For Class 3-4 cabovers, May’s average pricing came in at $17,938. This figure is $3,280 (22.4 percent) higher than April and $3,325 (22.8 percent) higher than May 2018. Looking at conventionals, Class 4 trucks averaged $25,266 in May, $5,717 (32.2 percent) higher than April and $5,484 (30.4 percent) higher than May 2018. Class 6 trucks averaged $20,902 in May, $5,579 (21.1 percent) lower than April and $190 (0.9 percent) higher than May 2018.

For more information, and to read the entirety of this month’s report, please CLICK HERE.