While analysts are running out of ways to say it’s flat, FTR says the trucking market may be about to turn a corner.

“The period of time where we’re sluggish is starting to transition to growth,” Avery Vise, vice president of trucking, says. “It’s not going to be particularly robust growth.”

It may not be particularly strong growth, but won’t fall off, either. Vise’s comments came during FTR’s State of Freight webinar on Thursday.

The overall economy

Chairman of the Board Eric Starks kicked it off by discussing the economy, which he called OK.

That’s another word for flat, particularly when it comes to consumer spending on goods. Consumer spending on services, he said, still has a little upside pressure, taking it’s time getting back to normal. Consumers aren’t overextended and debt levels are hovering at or just below pre-pandemic levels.

The economy continues to generate new jobs, Starks says, and the consumer price index for goods and services is falling. He warns that doesn’t mean prices are falling.

[RELATED: How intelligent business planning and SMART goals drive long-term profitability]

“We’re talking about the rate of growth,” Starks says. The Fed may want a faster pace on returning inflation to normal, but Starks says he expects it will hold the line until after the election.

“They’re going to try to stay out of that as much as they can,” he says.

Manufacturing, “the lifeblood of transportation,” remains healthy and gross domestic product is seeing some slight growth, while industrial production is recovering after a stall in 2022.

“This is what most of us in transportation have felt,” Starks says, laying out either negative percentages or hovering just around zero. “That’s not awesome, but any stretch of the imagination.”

He sees some slight growth going into the end of this year and into the next, with slightly more growth in the GDP for the goods transport sector.

“The growth rate is higher than industrial production. We get somewhere closer to the 2.5-3% type of growth within this market,” he says. “This is a status quo kind of forecast.”

The outlook for trucking

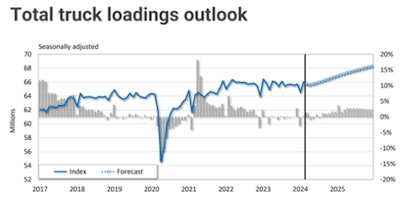

Vise predicted a stronger trucking market for that time period as well as for-hire carriers and driver populations come back into line with the pre-pandemic transportation market.

“Yes, we’ve been losing a lot of carriers,” Vise says, “but still have substantially more very small carriers than before the pandemic.”

As those small carriers go out of business, the drivers appear to be signing back on with larger fleets, Vice says, with driver capacity up by about 4%.

He also looked at truck utilization, which has fallen from 100% usage in 2022 down to the mid- to high-80s.

“The market has finally turned, but not particularly rapidly,” Vise says, predicting a 94% utilization — and possibly a corresponding rise in freight rates — this time next year.

However, there are still some red flags for carrier costs. That includes what he named as this year’s X factor, insurance costs.

New truck demand

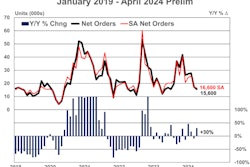

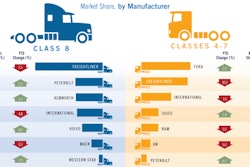

Dan Moyer is FTR’s new commercial vehicle analyst. He says an uptick in commercial vehicle sales will lag behind Vise’s market turn. That said, orders are up about 13% year-over-year.

“You would think orders would be more muted,” he says. Instead, it’s running at or just below replacement demand.

“That’s where we expect the market to end up for the entire year,” he says.

[RELATED: Class 8 orders lower in April in expected drop]

Inventory-to-sales ratios remain high, particularly in the medium-duty market, which has around five months of inventory on hand.

Also looming on the horizon are new greenhouse gas regulations for OEMs.

“There’s a multitude of compliance pathways the OEMs can use,” Moyer says, to achieve the thresholds set by the EPA.

“The good news is that [the OEMs] aren’t being forced into a single-technology environment,” FTR President Jonathan Starks says. “The bad news is that there’s a wide variety of technologies to be implemented, leaving carriers to make choices about what they’re going to institute.”