The American Truck Dealers (ATD) recently released its first quarter Truck Beat report.

According to ATD, commercial truck sales totaled 113,169 units through the first quarter of 2024, down 4.1% from first-quarter 2023. ATD says Class 8 trucks were the biggest culprit for the shift. In the first quarter, Class 8 sales fell by 14% year over year. Year over year, Class 8 sales declines in March 2024 followed declines in February. Even so, ATD says Class 8 truck sales in March were up 11.6% from the month before.

Additionally, medium-duty truck sales were a bright spot in the first quarter, totaling 57,307 through March and rising 8% year over year. Year over year, medium-duty truck sales have now increased for five straight months, ATD says.

[RELATED: Truck sales surpassed 500,000 units in 2023]

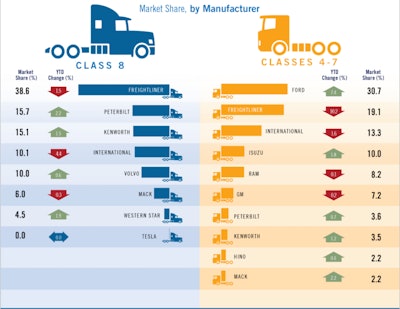

On a per OEM basis, Peterbilt was the biggest winner in the Class 8 market in the first quarter. ATD says Pete picked up 2.2% marketshare year to date in Q1. Kenworth also was up 1.5% percent, with Western Star adding 1.9% to rise to 4.5% of the total market. International was down 4.4% in the same period, with Freightliner behind at 1.9% down.

In Classes 4-7, Freightliner tumbled in the first quarter, down 10.1% year to date, while Ford was up 7.4% to move into the market leader at 30.7%.

Moving forward, in the Class 8 space, it is possible sales will remain below 2023 in the coming months. Class 8 orders tumbled in March, and the month's order count represented the first monthly count below 20,000 units since May 2023, reported ACT Research. ACT adds medium-duty truck orders are outperforming heavy-duty truck orders through the first quarter.

Within the used truck space, pricing remains depressed. ATD states J.D. Power reports the first major sale of trucks from the now-bankrupt Yellow Corporation took place on March 5, and the resulting jump in supply put downward pressure on pricing for single-axle day cabs and trailers.

ATD also offered its analysis on economic conditions that could impact truck orders and sales in the year ahead.

"Based on recent inflation data, we don’t think the Fed will end up cutting rates in June 2024," stated NADA Chief Economist Patrick Manzi. "This means higher rates for longer, which will hurt the trucking industry and the broader economy. Still, we expect a solid year for commercial truck sales, even though the total truck market is likely to see an overall sales decline from 2023.

He adds, "For all of 2024, we forecast that medium-duty sales will increase slightly to 248,000 units and heavy-duty truck sales will fall to 228,000 units representing a total market decline of roughly 6%."