Commercial truck sales in 2023 topped half a million units for the first time since 2019, the American Truck Dealers (ATD) reported this month in its most recent ATD Truck Beat.

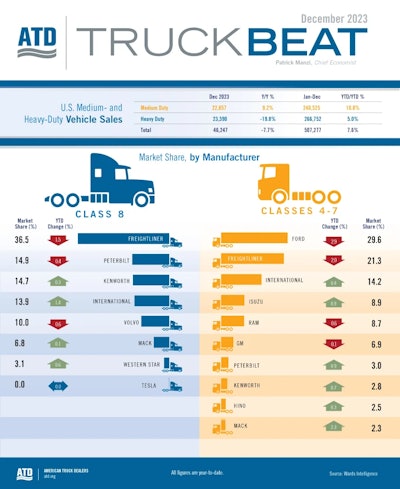

ATD says sales totaled 507,277 in 2023, up 7.6% from 2022. Sales of medium-duty trucks reached 240,525 in 2023, up 10.8% year over year. And heavy-duty truck sales totaled 266,752 in 2023, an increase of 5% from 2022.

The strong total could have been even higher had the market not slowed in December. ATD says sales of heavy-duty trucks slowed this December compared with a year earlier, with Class 8 truck sales dropping by 19.8%. According to ACT Research, Class 8 orders in December ended the fourth quarter totaling 26,500, a decline of 12.5% year over year. Class 8 orders cooled in December following a solid month for them in November, when they posted their strongest year-over-year gain since October 2022.

Within the Class 8 space, International was the biggest winner with 2023's strong sales. The Illinois-based truck maker raised its market share by 1.4% year over year, to 13.9%. Freightliner remained the market leader at 36.5% of market share but was down 1.5% year over year.

[RELATED: Mack's Randall says 2024 truck sales could exceed expectations]

In the Classes 4-7 market, Ford (29.6%) and Freightliner (21.3%) remain the top two producers, though both were down year over year. Mack was the industry's big winner, as its recently released MD Series earned 2.3% market share.

ATD also states despite recent weakness in freight market orders, truck buyers appear to be somewhat confident in the year ahead and continue to replace aging equipment even if those replacement rates will be a bit below 2023’s stellar performance.

The used truck market wasn't as strong in 2023. According to ACT Research, ATD reports the average retail price of a Class 8 truck sold in November 2022 was $59,292, down 6.2% from October 2023 and off a whopping 27.4% compared with November 2022’s average retail price of $81,657. November’s average sale price was the first average price below $60,000 since April 2021, ACT Research says.

[RELATED: Flat freight market keeps dealers’ expectations low for 2024]

ATD expects sales will trend down again this year after last year's cycle peak.

"We don’t expect another year of a half-million-plus commercial truck sales. Headwinds for the industry include high interest rates, declining truckload rates and new regulations in California that will severely limit California truck dealers’ ability to sell new Class 8 trucks," ATD states. "Our forecast is for medium-duty truck sales to increase slightly to some 248,000 units, while Class 8 truck sales will likely decline some 20% to around 213,000 units."