August saw a slight uptick in Class 8 truck orders but the market remains depressed in comparison to 2023, ACT Research and FTR announced in their preliminary market reports Thursday.

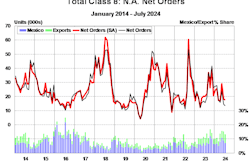

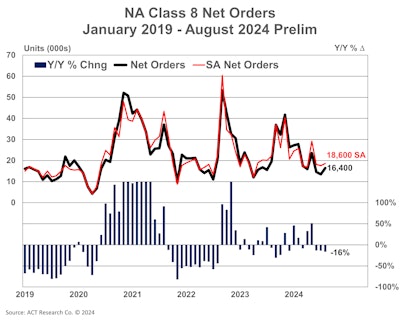

ACT Research estimates August orders at 16,400 units, up from July but down 16% year over year. FTR's preliminary total was 13,400 units, still up 2% from July but down 16% from 2023. FTR adds Class 8 orders for the past 12 months have now totaled 271,000 units.

“Class 8 orders remained at directionally and seasonally expected levels in August,” says Kenny Vieth, ACT Research president and senior analyst. “Historically, August is the last month of weak orders before the OEMs open their books to next year’s orders. As such, the month enjoys a large seasonal factor that boosts Class 8 orders nearly 12% above nominal levels to 18,600 units.”

[RELATED: Parts sales indicator falls for 17th consecutive month]

Yet FTR adds even accounting for seasonality, August's total was below expectations as the average month over month increase from July to August has been around 20% over the past seven years. The combination of a stagnant truck freight market and full or nearly full 2024 order boards presumably are the main factors behind a smaller than typical increase, the company says.

Vieth agrees, noting orders across the Class 5-8 markets were “generally in line with moderating expectations.” He says the drivers of those expectations are unchanged: for the Class 8 market, overcapacity in the U.S. tractor market leading to generational lows in for-hire carrier profits and a continued lack of traction in freight rates are a primary concern.

Year to date, FTR says Class 8 orders are running slightly below replacement demand levels at an average of 18,735 net orders per month, with the typically slower order period from April through August averaging 14,885 orders per month. Yet despite three consecutive months of lower year over year orders, the company adds strong early-year performance has kept 2024 year to date net orders up 14% year over year.

[RELATED: Class 8 production under pressure, ACT reports]

The medium-duty market had similar results on a monthly and annual basis. Vieth says preliminary Classes 5-7 orders improved from July, rising 1,200 units month over to 17,300 units in August. The market was down 16% year over year. Vieth says historically August is the beginning of stronger orders for Classes 5-7 vehicles as school bus order season gets underway.

“For the medium-duty market, the focus is on increasingly overextended US consumers, the impact of high interest rates on discretionary spending, and extremely weak RV demand,” he adds.