The used truck market saw a huge uptick in activity last month, ACT Research reported Thursday.

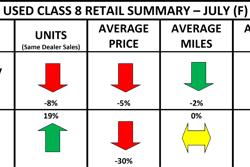

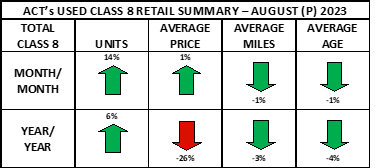

The company says Class 8 same dealer used truck retail sales volumes surged 14% month over month, an huge monthly change. ACT Vice President Steve Tam notes August is historically a strong month for used sales but taking that into account, last month was a big one for movement.

"The uncharacteristically large improvement this month is likely a reflection of the increased availability of units at more attractive prices," Tam says. "August is the second-best sales month of the year, more than 8% above average and 10% better than July."

[RELATED: ACT states half of commercial vehicles to be zero emissions by 2040]

Tam says in three of the past four months, used Class 8 average retail sale prices have reflected "either below normal or typical levels of month-to-month depreciation."

He adds, "Looking ahead to next month, the prices, against which longer-term comparisons will be made, will be considerably lower than they have for the first half of 2023. With destocking on shippers’ inventory at hand, freight is expected to stop contracting and perhaps even return to growth soon. At the same time, the number of trucks servicing the freight market continues to decline. These are the exact ingredients for a rebalancing of capacity and the subsequent return to a more normal used truck market."