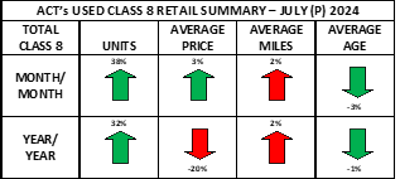

ACT Research found an unexpected jump in used Class 8 same-dealer retail sales volumes for July. Month-over-month, volumes jumped 38%, the company said in the State of the Industry: U.S. Classes 3-8 Used Trucks.

[RELATED: Check out our upcoming September webinar on bolstering your bottom line!]

"Despite slow freight and freight rate improvement and falling, but elevated, interest rates, the buyers' market remained attractive to quite a few truckers," says Steve Tam, vice president at ACT Research. "Seasonality called for a decrease of about 2% month-over-month. According to plan, auction activity fell from its usual final-month-of-the-quarter high, down 41% month-over-month. Wholesale transactions advanced 7.1% month-over-month."

Tam points out the increase is based on preliminary data; final numbers may vary.

"Altogether, July sales rose 14% from June," he says. "If history is to be believed, August sales should jump a bit."

The report provides data on the average selling price, miles and age based on a sample of industry data. In addition, it gives the average selling price for top-selling Class 8 models for each major truck OEM — Freightliner (Daimler), Kenworth and Peterbilt (Paccar), International (Navistar), and Volvo and Mack (Volvo).