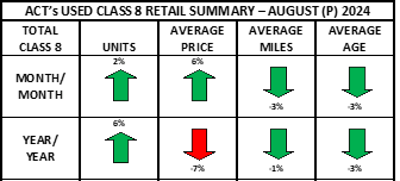

ACT Research says August used truck sales fell below expectations after July's better-than-expected numbers.

[RELATED: Check out our upcoming September webinar on bolstering your bottom line!]

"Stubbornly persistent softness in spot freight and freight rates coupled with still high but improving inflation and interest rates, have failed to act as barriers to entry or dissuade truck buyers," says Steve Tam, vice president at ACT Research. "Seasonality called for an increase of just over 9% month-over-month. Auction activity improved 21% from July, as did wholesale transactions, up 24%. Altogether, sales rose 12% from July."

[RELATED: ACT: Excessive inventories put damper on Class 8 demand]

The numbers were released Monday in the preliminary release of State of the Industry: U.S. Classes 3-8 Used Trucks. The report provides data on the average selling price, miles and age based on a sample of industry data. The report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs, including Freightliner, Kenworth, Peterbilt, International, Volvo and Mack.