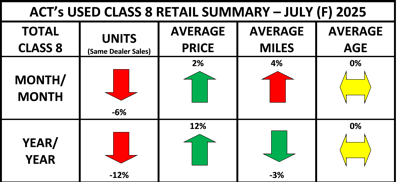

Used truck retail prices crept up in July, climbing up 2.3% from June and 12% from July 2024, ACT Research reports in its State of the Industry: U.S. Classes 3-8 Used Trucks report.

“The used truck market finds itself in an interesting predicament these days. On the new truck side of the business, the industry has produced and consumed trucks at above replacement rates for seven years running. The net result is excess capacity,” says Steve Tam, vice president at ACT Research.

“Faced with declining demand, the OEMs have responded by laying off workers and reducing output. But without a meaningful increase in freight, it will take time to consume the unused capacity. Fewer new trucks rolling off the assembly line means reduced trade activity, somewhat alleviating concerns about excess used truck inventory. This seems to be helping used truck valuations.”

Tam adds at least some portion of the increases the industry has seen in new truck prices is carrying over into the secondary market.

“Along with used truck demand stemming from traditional new truck buyers turning to late-model, low-mileage used trucks as substitutes for new trucks, the used truck pricing environment appears to have turned the corner,” he says.