The days are numbered for pent-up pandemic stimulus and economic demand propping up the economy, analysts say. But, the good news is, barring any black swans, the landing is expected to be a soft one.

ACT Research on Thursday released its North American Commercial Vehicle OUTLOOK and FTR held a webinar forecasting the future economy.

"We've spent most of the past year warning about a potential recession," ACT President and Senior Analyst Kenny Vieth says. "Admittedly, the economy has proven more resilient than initially envisioned. That said, we think broader economic conditions are softening, and we reiterate our cautious view for slowing 2H'23 production rates. We continue to expect a shallow recession to materialize, centered on mid-year."

[RELATED: Is uncertainty the new normal? TPS survey responders are acclimating to market shifts]

FTR analysts Avery Vise and Bill Witte compared their forecasts from six months ago to what the economy looks like today, then forecast out into 2024. Their models show that expected weakness this year has been delayed, but is still coming.

Both the gross domestic product, GDP, and the unemployment rate bested Witte's forecasts from November, he says. The economy remains strong despite headwinds of inflation and instability in the political and financial sectors.

"I think that, relative to six months ago, where I was so uncertain about possibilities that I wouldn't even put down a single forecast, the situation is somewhat more predictable and that's somewhat less of a risk," Witte says.

But he warns that there is still the not-inconsiderable risk of the black swan -- something completely unexpected -- showing up, particularly with the U.S. debt ceiling and bank failures.

"The possibility just that the political system really turns ugly, given that we're heading into the election, can cause really unexpected things to happen," he says.

Vise, the vice president of trucking for FTR, agrees.

"The actual organic economics are pretty stable and have a pretty narrow range," he says, adding that a collapse in either consumer spending or the labor market seems unlikely. "Let's hope that no one will want to play with what happens if we really do have a default."

Witte and Vise agree that accumulated savings in the consumer sector, fueled by pandemic stimulus cash, will disappear sometime in 2024.

"There's still substantial support here for continued consumption," Witte says. However, the American consumer will eat that support next year.

"We will exhaust this," Vise says. "It's just human nature."

Also expected to be exhausted, but this year instead of next, is pent-up Class 8 tractor demand. The pandemic and tight supply chains meant that new trucks had to wait and that waiting has fueled strong sales. But that will come to an end, ACT says.

[RELATED: Class 8 orders plummeted in April]

At the same time, lower freight rates, higher equipment and borrowing costs, improved equipment availability and smaller profits will put downward pressure on the market overall. ACT is also worried about the debt ceiling negotiations in Washington, D.C.

"Aside from near-term Class 8 demand timing, the immediate wildcard in our forecast remains the debt ceiling," Vieth says. "While the Fed plays a major role in determining the interest rates businesses and individuals pay to borrow money, the coming debt battle may serve to pause business investment, unnerve investors, and push interest rates even higher, which could induce a deeper recession, sooner."

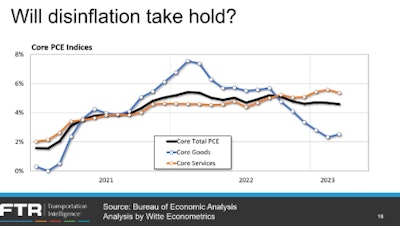

Without a debt ceiling crisis or other black swan, Witte does forecast eventual disinflation and a subsequent lowering of interest rates. But timing is proving tricky. FTR's analysts say that the labor market is forcing wages up, which also forces up costs. Services, which Witte says is two-thirds of the story when it comes to pricing, is underlined by wage costs.

"Bringing down services inflation is going to be a hard thing to do," he says. "Even though my model shows downward pressure on prices and shows prices falling, I think that's a real question whether that will materialize. So far, I'm worried about it."

Witte says he's forecasting the Federal Reserve's recent increase in interest rates will be its last for a while. He looks for a pause now that will last until reductions begin well into 2024 and, even then, he doesn't look for them to come down much.

"The Federal Reserve is in a very difficult situation and it's of their own making," he says. That situation comes from keeping rates low for too long and a fiscal policy that was highly stimulative, Witte added.

"Fiscal policy is still expansive and will continue to be expansive," he says. "At the same time, there's the financial market situation [bank failures], which is entirely predictable after you have interest rates that are way below equilibrium for a very long time."