After another month of steady but uninspiring orders, the trailer market appears in stay afloat mode as fleets continue their wait-and-see strategy, ACT Research reported Tuesday in its state of the trailer market report.

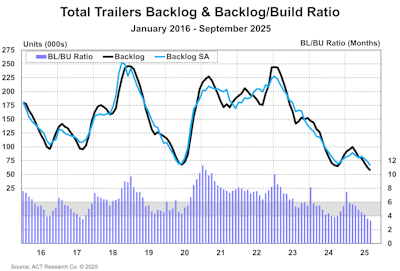

“With lower build rates insufficient to offset soft orders in September, the industry backlog-to-build ratio fell 30 basis points sequentially, to 3.3 months,” says Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research. “September’s build rate and the current backlog commit the industry into the start of 2026.”

McNealy reports cancelations started to escalate in February and have remained elevated relative to backlog since. She says September’s rate, as a percentage of backlog, was 5.6%, bothoverstated and the highest rate since May 2020.

[RELATED: See which states added the most prospects in Q3 in our new fleet market analysis report]

“Data continued to show high dry van cancelations, with reefers and the tank segments also elevated. Per OEMs, cancelation activity is primarily from dealers, as they work to control stock against a backdrop of uncertainty and cost concerns,” she says.