The trailer market “survived 2025” but good news remains elusive, ACT Research reported this week in its most recent update on the production sector.

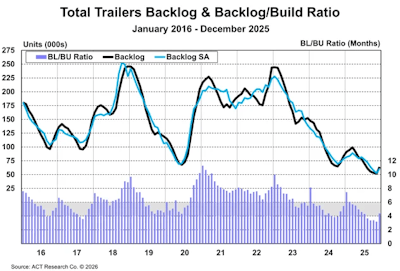

“Bigger backlogs and a lower December build rate conspired to push the backlog-to-build ratio higher for the first time in 2025,” says Jennifer McNealy, director of CV market research and publications at ACT Research. “Backlogs started the year at 7.5 months and trended lower from there. December’s 4.4-month ratio commits the industry into [the second quarter of] 2026.”

McNealy also states the cancellation rate, as a percentage of backlog, remained high at a more subdued 1.8% versus November’s 2.5% rate.

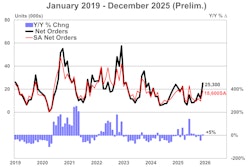

[RELATED: Trailer orders bounced up 86% month over month in December]

“Data continued to show elevated cancellations in the van and tank segments. The highest cancellation rates came from the tank segments, attributed to a decline in oil/gas activity,” she says.

Ultimately, McNealy says end-of-2025 challenges continue as the trailer industry enters 2026, and opportunities in early part of the year remain thin.

“Positively, freight rates are now rising and the need to replace aging equipment continues to build. Pent-up replacements are expected to improve demand later this year,” she says.