The used truck pricing crash is here.

J.D. Power reported Thursday in its July 2022 Commercial Truck Guidelines industry report that prices fell dramatically again in the auction and retail spaces in June as the used truck industry continues to course correct after more than a year of record growth.

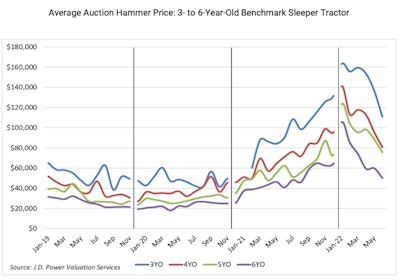

In the auction sector, volume increased substantially this month (the highest figure in 18 months) and pricing continued to steeply decline.

"It appears volume is driven mainly by small fleet liquidations, large fleets offloading their oldest units and individuals either exiting the industry or going to work for a fleet," J.D. Power reports. "Pricing declined throughout the month, which means the averages below include higher pricing from earlier in the month." Actual current pricing is lower than these figures reflect and, in fact, should be at or near year over year parity at time of publication."

In the popular 2- to 6-year-old truck market, J.D. Power's average June auction pricing was:

- Model year (MY) 2021: $153,889; no basis for comparison in May

- MY 2020: $111,001; $25,731 (18.8 percent) lower than May

- MY 2019: $80,727; $14,926 (15.6 percent) lower than May

- MY 2018: $75,641; $12,811 (14.5 percent) lower than May

- MY 2017: $50,107; $9,747 (16.3 percent) lower than May

In June, 3- to 5-year-old trucks averaged 16.7 percent less money than May, but 19.4 percent more money than June 2021. Year over year, J.D. Power says late-model trucks sold in the first six months of 2022 averaged 80.7 percent more money than the same period of 2021. Year to date, 4- to 6-year-old sleepers have depreciated 6.9 percent per month on average.

Average auction selling price for 3- to 6-year-old sleeper tractors, adjusted for mileage.

Average auction selling price for 3- to 6-year-old sleeper tractors, adjusted for mileage.

The company also notes through June, late-model pricing remains 68.9 percent higher than the previous pre-pandemic peak in Q3 2018, so values are still extremely high by historical standards. Also, the newest, lowest-mileage trucks have barely depreciated at all, the company adds.

"Pricing will continue to drop closer to historical norms, but current freight economics support a relatively healthy used truck market once we work through the excess capacity of the pandemic spot rate bubble," the company states.

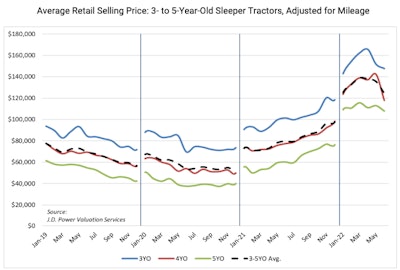

As expected, the retail market also pulled back substantially for the first time in June.

[RELATED: ACT Research adds mild recession into base forecasts]

"When we identified the auction market correction that started in mid-April, we stated retail pricing generally takes two to three months to adjust to market shifts. June marked month number three and, right on schedule, pricing for individual trucks pulled back," J.D. Power reported.

As with all market shifts, the least-desirable trucks were hit hardest at first. New, low-mileage trucks available are still bringing extremely strong money.

J.D. Power states the average sleeper tractor retailed in June was 69 months old, had 464,365 miles and brought $108,641. This figure is an 8.9 percent drop from May’s record high and supports the company's assessment that the retail market correction is underway. Compared with May, this average sleeper was two months newer, had 20,446 (4.6 percent) more miles, and brought $10,589 (8.9 percent) less money. Compared with June 2021, this average sleeper was one month newer, had 13,466 (3.0 percent) more miles, and brought $41,882 (62.7 percent) more money, J.D. Power adds.

Within the 2- to 6-year-old truck cohort, retail pricing was:

- MY 2021: $182,303; $5,135 (2.7 percent) lower than May

- MY 2020: $147,761; $4,016 (2.6 percent) lower than May

- MY 2019: $117,843; $24,263 (17.1 percent) lower than May *

- MY 2018: $107,899; $5,003 (4.4 percent) lower than May

- MY 2017: $88,963; $7,661 (8.6 percent) lower than May

(* J.D. Power states MY 2019's total was particularly negatively affected by a relatively large group of identical trucks that sold for unimpressive money. Eliminating those trucks would still result in a 15 percent decrease month over month, so the figure is not far off from actual overall market movement.)

Average retail selling price for 3- to 5-year-old sleeper tractors, adjusted for mileage.

Average retail selling price for 3- to 5-year-old sleeper tractors, adjusted for mileage.

The most common 3- to 5-year-old trucks averaged brought 8.2 percent less money in June than May, J.D. Power says, though trucks in this age group brought 77.9 percent more money in the first six months of 2022 than the same period of 2021.

Due to June’s lower figures, average price movement per month in 2022 is now flat for the year. Overall, the company adds retail pricing is still roughly 50 percent higher than the last pre-pandemic peak in late-2018, but that difference will continue to close in upcoming months.

Additionally, dealers retailed an average of 3.2 trucks per rooftop in June, 0.4 more than May. Retail sales volume remains somewhat depressed as the sense of urgency has greatly diminished and fewer check writers are shopping for trucks. This has resulted in a massive uptick in dealer retail inventory, Sandhill Global, parent company of TruckPaper, also announced Friday.

"Retail pricing usually moves less drastically than auction, but we have most likely entered a depreciation period that will last until the market corrects closer to historically typical levels," J.D. Power states.

The pricing fall also bled into the medium-duty sector, though it wasn't as severe.

Starting with Class 3-4 cabovers, J.D. Power says its benchmark group averaged $28,752 in June. This figure is $6,467 (18.4 percent) lower than May, and $6,146 (27.2 percent) higher than June 2021. Class 4 conventionals average pricing was $40,319 in June, $667 (1.7 percent) higher than May and $11,221 (38.6 percent) higher than June 2021. Class 6 conventionals averaged $46,228 in June, $4,240 (8.4 percent) lower than May and $14,691 (46.6 percent) higher than June 2021.

"Compared with last year, medium-duty trucks continue to bring extremely strong money. It will take notable degradation in macroeconomic conditions to cause any real pullback in pricing in upcoming months," the company says.

Overall, J.D. Power says pricing are likely to continue falling in the immediate months ahead as the market recalibrates itself, but the firm remains somewhat optimistic about the market longer term and into 2023.

"The degradation in pricing we’ve seen since April is due mainly to the adjustment back to a more normal freight rate environment and somewhat improved new truck availability," the company states. "On the retail side, June was the first month to show clear evidence of a correction in that channel. The sense of urgency is mostly gone, and potential buyers are cautious. However, contract freight activity is still healthy, fleets will probably keep some capacity in reserve due to the unpredictable nature of the ongoing supply chain mess and the new truck backlog is still substantial.

The company adds, "Given these factors, the market should support pricing in the neighborhood of the last pre-pandemic peak of late 2018."

For more information, and to read the entirety of this month’s report, please CLICK HERE.