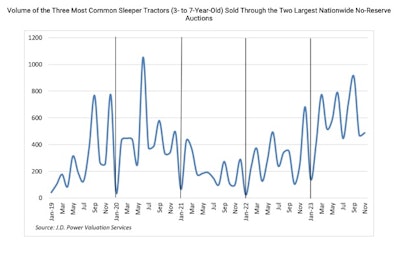

J.D. Power says depreciation is finally slowing as the year ends. Monthly depreciation is down to 4% for 2023.

The company says late-model trucks with average or lower mileage for their age have lost less than 4% of their value each month in the fourth quarter. High-mileage trucks have probably seen the worst of their devaluation, analysts say.

Average pricing for the benchmark three- to seven-year-old truck in November was:

- 2021: $64,105; $3,080, or 5.1%, higher than October.

- 2020: $46,911; $5,562, or 10.6%, lower than October.

- 2019: $30,740; $825, or 2.6%, lower than October.

- 2018: $28,236; $2,047, or 7.8%, higher than October.

- 2017: $19,189, $3,328, or 21%, higher than October.

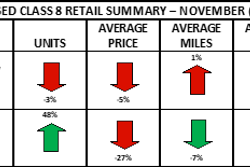

Four- to six-year-old trucks brought 3.9% less money than in October and 40.2% less than in November 2022. For the first six months of 2023, late-model sleepers brought 41.6% less money than the same period of 2022.

The average sleeper sold was 71 months old with 429,243 miles. The price tag was $62,252. Compared with October, this average sleeper had fewer miles and brought 7.7% less money. Compared with November 2022, it was two months newer, had 8.5% fewer miles and brought 30.7% less money.

November average pricing for two-to-six-year-old trucks was:

- 2022: $109,962; $8.071, or 6.8%, lower than October.

- 2021: $88,264; $2,902, or 3.2%, lower than October.

- 2020: $61,792; $9,940, or 13.9%, lower than October.

- 2019: $52,811; $2,663, or 4.8%, lower than October.

- 2018: $40,543; $1,514, or 3.6%, lower than October.

J.D. Power says that end-of-year sales with identical specifications pulled down November's averages. Actual markets for individual models were more nuanced, it says, despite the substantial declines shown above.

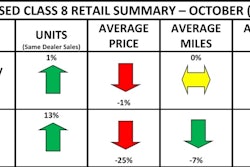

Three-to-five-year-old trucks brought an average of 7.1% less money than in October and 31.4% less than in November 2022. The first 11 months of 2023 averaged 31.4% less money than the same period of 2022. Monthly depreciation is averaging 3.2%, and late-model sleeprs are just under the last strong pre-pandemic period of 2018 in nominal dollars, or around 20% less when adjusted for inflation.

Daycabs are depreciating at a slightly higher rate (3.5%, on average) than sleepers because more of these trucks are in the marketplace, J.D. power says. However, daycabs are bringing better residuals than sleepers in 2023, bringing equal or better money after only three or four years of age.

As the market moves into 2024, J.D. Power is forecasting a bottom in the freight market. Used truck pricing is still 20% higher than the lowest month of 2019, the weakest pre-pandemic point. Excess inventory will continue to move through auction, wholesale and retail channels, but the company says the post-pandemic correction looks to be maturing.