Trailer OEMs and component suppliers show strong demand and lingering supply chain difficulties, keeping expectations high for a strong 2023 trailer market.

[RELATED: Trailer orders slip back in March]

Despite OEMs expanding availability, the industry cannot yet meet full demand because manufacturers are fending off high commodity costs, long lead times for components and improved but still challenging labor conditions, the ACT Research "State of the Industry: U.S. Trailers" report says.

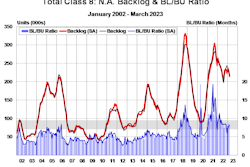

"Seasonally adjusted, the backlog-to-build ratio rose 100 basis points month over month to 8.3 months, with weaker build in a seasonally strong month, from 7.3 months in February," says Jennifer McNealy, director of commercial vehicle research and publications at ACT. "Seasonal adjustment takes dry van BL/BU to 8.3 months and reefers to 10.7, so either way one looks at it, with or without seasonal adjustment, this essentially commits the industry very deep into 2023."

March's build per day declined 3% to 1,318 units per day from February's 1,359, ACT says. But build is up 14% month over month due to three more build days in March than February. That's a 14% increase.

"Production growth continues its upswing, and our projections point to a continuation of that trend," McNealy says.