Facing a tough 2023 fraught with soft freight rates and lingering supply chain snarls – and a UAW work stoppage at the facility that makes powertrain components for its trucks – Volvo’s marketshare slipped to 10.2% in the combined U.S. and Canadian markets. Volvo Trucks retailed 30,222 trucks in the two markets last year.

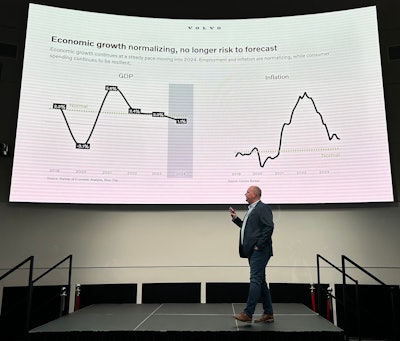

But economic growth thus far in 2024 continues at a steady pace, inflation and employment are normalizing, and there are signs that freight rates are beginning a slow climb – all positive indicators that Volvo’s 2024 and beyond is bright, said Magnus Koeck, vice president of strategy, marketing and brand management at Volvo Trucks North America.

Recovery in freight rates in the second half of this year should set up the 2025-2026 freight cycle. Volvo will benefit from that, but a big part of its future growth, of course, is its newly revamped VNL on-highway tractor.

“Ninety percent [of the truck] is new,” Koeck said. “This is a platform developed in North America for North America.”

The prior generation VN Series platform was based on European models refined for the American market and had been for nearly 20 years, but Koeck emphasized that in sketching the company’s new on-highway tractor, designers weren’t tied to transatlantic legacies.

“It’s the end of an era, but it’s also the beginning of a new era,” he said, “and everything is changing … so Volvo decided to change everything.”

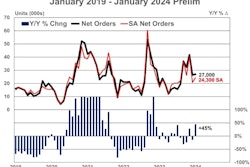

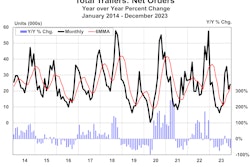

Truck orders this year are expected to come in around 270,000, followed by a dip in 2025.

“2026 will most likely be a record year for the U.S. and Canada,” Koeck forecast, noting the likelihood of a lingering pre-buy effect and adding that fleets will not wait until 2026 to buy units compliant with tighter 2027 emissions regulations.

Fleets in 2020 and 2021 got a front-row seat for what can happen when everyone orders trucks at the same time: they’re almost impossible to find because OEMs can’t build them fast enough. With that lesson in hand, Koeck said motor carriers are likely to refresh buying cycles sooner than during previous pre-buys.

“The pre-buy will start earlier. We probably will see that already this year in the back half and into ’25 and, of course, into ’26,” he said. “’27 will be a big dip due to new emissions regulations … with quite a dramatic increase in prices due to the new regulations.”