April was a month of little change in the used truck sector, J.D. Power reported Monday in its April 2024 Commercial Truck Guidelines report.

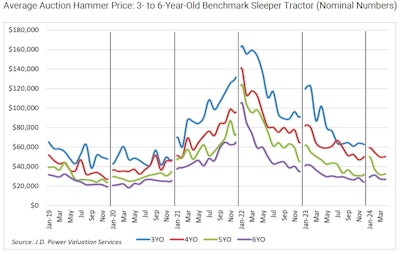

J.D. Power reports auction volume for Class 8 sleeper tractors pulled back last month, which is typical. On a mileage-adjusted basis, pricing for these trucks was little changed from March.

However, the company adds anyone tracking the large number of trucks with very high mileage for their age would be excused for feeling like trucks were bringing less money.

Looking at late-model sleeper tractors, J.D. Power states average pricing in its benchmark model was:

- Model year (MY) 2022: Insufficient data due to very few sales

- MY 2021: $50,173; $357 (0.7%) higher than March

- MY 2020: $32,433; $640 (2.0%) higher than March

- MY 2019: $26,749; $457 (1.7%) lower than March

- MY 2018: $19,301; $2,197 (10.2%) lower than March

J.D. Power says 4- to 6-year-old sleepers brought essentially equal money to March, and 21.4% less money than in April 2023. Values for this age group are now about 7% lower than the strong pre-pandemic period of 2018 in nominal figures, or about 23% lower if adjusted for inflation, J.D. Power adds. Current pricing is about 43% higher than the last market nadir in late 2019, or about 18% higher if adjusted for inflation. The company adds depreciation in 2024 is averaging 5.6% per month. Pricing is now roughly halfway between 2018 (strong) and 2019 (weak) levels in real numbers.

[RELATED: Taylor & Martin acquired by Japanese company]

"Two industry metrics that generally correlate to used truck values, capacity utilization and freight rates, suggest truck pricing still has some depreciation to work through," the company adds. "Capacity utilization estimates put us much closer to 2019 than 2018 currently, and both spot and contract freight rates are below 2019 in real numbers. As such, April’s results were somewhat stronger than expected."

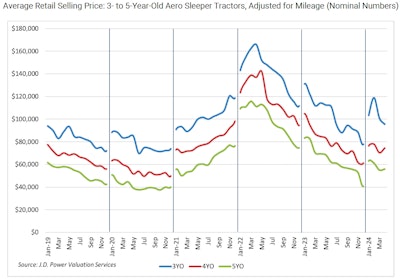

In the retail space volumes were down, but price was close to April.

Overall, the average sleeper tractor retailed in April 2024 was 72 months old, had 452,256 miles and brought $60,505, the company says. Compared with March, this average sleeper was one month older, had 14,976 (3.4%) more miles and brought $418 (0.7%) less money. Compared with April 2023, J.D. Power says this average sleeper was four months older, had 10,852 (2.5%) more miles and brought $14,062 (18.9%) less money.

The company states April’s average pricing for late-model trucks was as follows:

- MY 2023: $137,378 $261 (0.2%) lower than March

- MY 2022: $95,367; $5,379 (5.4%) lower than March

- MY 2021: $74,543; $4,113 (5.8%) higher than March

- MY 2020: $55,868; $883 (1.6%) higher than March

- MY 2019: $43,524; $250 (0.6%) lower than March

- MY 2018: $34,273; $314 (0.9%) lower than March

Among the popular 3- to 5-year-old cohort, sleeper tractors brought essentially equal money in April 2024 to March, with just 0.2% separating the two months. J.D. Power states that group of trucks brought 15.8% less money in April 2024 compared with April 2023.

"Late-model sleepers are bringing money comparable to the last strong pre-pandemic period of late 2018 in nominal dollars, or about 19% less when adjusted for inflation. Compared with the last weak pre-pandemic period, late-model sleeper values are now running 30% higher in nominal dollars or 7% higher in real dollars," the company reports. "Depreciation in 2024 is averaging 2.3% per month, which is historically typical."

Segmented out, J.D. Power reports daycabs continue to bring equal or better money than sleepers after three years of age, apples-to-apples. Compared with March 2024, late-model daycabs brought 2.2% less money in April. Compared with April 2023, this segment brought 11.8% less money. Depreciation in 2024 is averaging 1.3% per month for those units, the company adds.

The biggest note in April's retail data was volume. J.D. Power reports April’s retail environment was unexpectedly weak, with sales per rooftop averaging a dismal 2.1 trucks. This figure was 0.5 truck lower than March, and the worst result since the Great Recession.

"April is not typically a weak month for retail sales, so we could be entering the late-spring doldrums a little early," the company reports.

For more information, and to read the entirety of this month’s report, please CLICK HERE.