We all know there is a shortage of qualified professionals in trucking.

We don’t ever have enough drivers or technicians, and over the last several years the number of associates working in other roles within the industry have dwindled as well. Pandemic-forced downsizing in 2020 took some of them, but most of the losses (or lack of backfilling) we’ve seen in trucking recently is simply due to age.

The trucking workforce is old, and every day we lose more people to retirement than we bring in through our recruiting pipelines.

I’ve written about the leaks in our recruiting pipeline before; Online Editor Bill Grabarek touched on the same topic in his excellent evaluation of our diesel technician survey last month. There is no doubt we need to do a better job presenting our industry to young people, showcasing our excellent career opportunities and recruiting young professionals to lead the next generation of trucking.

But improving our recruitment efforts alone won’t solve our staffing issues. Globally and domestically, our population is aging.

The United Nations reported in 2019 there were 703 million persons aged 65 and older alive in the world — 9 percent of the global population. Those numbers are projected to jump to 1.5 billion and 16 percent by 2050. Coupled with a consistently declining global birth rate, the world is heading toward a future where each year (nay, each day) the number of people aging out of the workforce will surpass the number entering in.

You thought hiring today was exhausting? Imagine how things will be when every industry is facing the same uphill battle you already are?

Competition for good workers will become fiercer, and not just between you and your direct competitors. The talent pool you draw from will also be fished by retail and warehouse operations, food services, hospitality, automotive and other transportation sectors. Many of which have deeper pockets than you do. Maybe today you have the revenues and margins to bump your starting wages to compete with them. Who knows about tomorrow? No one can keep up with the Joneses forever.

The good news is maybe you won’t have to.

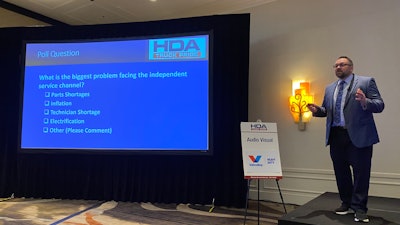

Last week at the 2022 HDA Truck Pride Annual Meeting in Orlando, Fla., host of the Heavy-Duty Parts Report Jamie Irvine presented a business session around the digital sales channel, and how aftermarket distributors can embrace technology to thrive in the years ahead. With the focus primarily on internet resources, Irvine showed attendees how existing and emerging technologies can be leveraged by distributors to reduce workloads for existing sales associates, while improving customer service, customer engagement and operational efficiency.

Focusing on the theory of working smarter, not harder, Irvine urged attendees to be open to e-commerce, digitizing their business and investing in technologies today that will prove their ROI over time as recruiting employees becomes increasingly difficult.

“Slowing birth rates are going to intensify the competition for capable workers,” he said. “This is not just a trucking industry problem. We are one of many industries facing this reality … We have to leverage technology to give ourselves a chance.”

I could not agree more.

I recognize technology is costly. It’s an investment. Regarding e-commerce solutions specifically, it can seem counterintuitive for a parts distributor to invest in an online store when the good old-fashioned way has worked for decades and continues to yield record yearly profits.

[RELATED: HDA Truck Pride members talk pricing, hiring changes]

But the point of e-commerce isn’t just to be online. It’s not about competing with Amazon, eBay or another global entity. As Irvine astutely points out, distributors shouldn’t consider investing in digital sales solutions to compete with Amazon, they should do it to automate as much of their sales as possible — both for their benefit and their customers.

Irvine said Friday his research indicates at least 35 percent of heavy-duty parts sales are good candidates to be shifted to digital purchasing and could scale as high as 50 percent depending on the robustness of a digital sales solution and a distributor’s customer makeup.

Think about how that could help your sales team. If you have 12 salespeople now, imagine a world where you add a digital sales solution. Suddenly your customers are making their stock and commodity orders online, freeing up your team to address more difficult parts requests and hunting for new business. Revenues would rise. Honestly, you’d probably have more people than you’d need.

And while I wouldn’t suggest getting rid of anyone — make hay while the sun shines, they say — you would probably be able to survive a retirement or two if you knew your e-commerce solution was doing the work of four to six employees.

You also wouldn’t have to worry about the solution chasing a higher commission at a competitor or fear it retiring in two years when it turns 65. Once you invest in a digital sales channel, it’s yours for as long as you want it.

The workforce talent pool isn’t getting any denser. Every day more lines are cast; more nets drop into the waters. Maybe it’s time to take your pole and go somewhere else.