Shifting volumes in the auction and retail sectors had little impact on the continued downward trend in used truck pricing, J.D. Power reported Wednesday in its March 2023 Commercial Truck Guidelines industry report.

In the auction space, J.D. Power says buyers are still paying a premium for trucks with low mileage when they can find them. Among 2- to 6-year-old trucks in the company's benchmark model, February pricing was as follows:

- Model year (MY) 2021: $122,000; no basis of comparison with January

- MY 2020: $80,100; $1,650 (2.0%) lower than January

- MY 2019: $55,018; $6,800 (11.0%) lower than January

- MY 2018: $41,139; $25 (0.3%) higher than January

- MY 2017: $29,215; $8,035 (21.6%) lower than January

J.D. Power reports late-model trucks averaged 4.5% less money than January, and 34.9% less money than February 2022. To date this year, late-model sleepers are bringing 39.2% less money than the same period of 2022. Monthly depreciation in 2023 is currently averaging 4.5%.

J.D. Power does note trucks with under 400,000 miles continue to bring a substantial premium. The newest model years available in the marketplace are bringing about 55% more money than the strong pre-pandemic period of 2018, assuming average mileage per year. When adjusting values over time to 2023 dollars, that difference drops to about 37%.

[RELATED: Little change in used truck market in low-volume January]

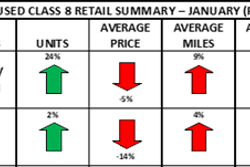

Within the retail sector, volume wasn't as high but pricing continued to slip.

The average sleeper tractor retailed in February 2023 was 73 months old, had 470,838 miles and brought $79,157. Compared with January, J.D. Power says this average sleeper was identical in age, had 1,163 (0.2%) more miles, and brought $8,022 (8.9%) less money. Compared with January 2022, this average sleeper was five months older, had 16,223 (3.6%) more miles, and brought $2,402 (2.9%) less money.

The company says February's average pricing for 2- to 6-year-old trucks was as follows:

- MY 2022: $162,668; $8,537 (5.5%) higher than January

- MY 2021: $121,816; $9,209 (7.0%) lower than January

- MY 2020: $94,863; $10,018 (9.6%) lower than January

- MY 2019: $82,459; $687 (0.8%) lower than January

- MY 2018: $63,747; $795 (1.2%) lower than January

J.D. Power reports 3- to 5-year-old trucks brought an average of 6.2% less money than January, and 24.8% less than February 2022. The first two months of 2023 averaged 20.1% less money than the same period in 2022.

Additionally, late-model sleepers are still bringing about 35% more money than the last strong pre-pandemic period of 2018, assuming average mileage per year. Adjust values over time to 2023 dollars, that difference drops to about 19%, the company says.

[RELATED: How inventory decision making is driving retail used truck success]

Sales per rooftop also slipped, down 0.2 trucks from January to 2.3 trucks. That's the second-lowest result recorded since the Great Recession, J.D. Power reports. The company adds "cooler freight environment, higher supply of trades, declining equity and tougher credit are headwinds that will limit used truck pricing for the next few months."

Within the medium-duty market the story was similar, with pricing down in all three segments tracked by J.D. Power.

Class 3-4 cabovers in the company's benchmark group averaged $23,119 in February. This figure is $5,139 (18.2%) lower than January, and $9,572 (29.3%) lower than February 2022. Class 4 conventionals averaged $37,179 in February, $258 (0.7%) higher than January, and $1,155 (3.0%) lower than February 2022. Class 6 conventionals averaged $44,678 in February, $5,239 (13.3%) higher than January, and $7,003 (13.6%) lower than February 2022.

In looking forward, J.D. Power notes the collapse of Silicon Valley Bank is introducing a big dose of uncertainty into the macroeconomy.

"The fallout could be felt in several different ways, few of them positive. At this point we’ll note that the freight environment was stable to cooling in February while the supply of available trucks increases. Downward pressure on sleeper tractor pricing will continue to increase during the next few months, at least," the company says.

For more information, and to read the entirety of this month’s report, please CLICK HERE.