It’s almost over. Steve Tam says that’s what the data shows. The used truck market has been soft for more than two years, stuck in the down point of its business cycle due to weak freight dynamics and overcapacity.

Speaking Friday at the Used Truck Association (UTA) Convention, Tam says neither of those challenges have been solved, but both are getting better. Freight is beginning to tick up, and historical business cycle data and economic projections indicate loads and tonnage are likely to climb in 2025. As for capacity, Tam says the used truck market has too many trucks but it’s not “drowning in inventory,” which means if the freight market picks up, the used truck sector should pick up quickly to support it.

And ACT Research believes the market will pick up.

[RELATED: UTA speaker warns inflation could dominate 2025 economy]

Tam says freight indices are showing shipping conditions should level set for carriers and shippers around the new year, with fleets earning the upper hand as freight trends higher into 2025. How quickly will the market go up? Tam doesn’t expect a sudden boost but says when the market starts to grow, he thinks the spot market will benefit first and could see rates rise by 10 to 20%. Those are good numbers for used truck dealers because small fleets and owner-operators dominate the spot market and will likely be enticed to expand and capitalize on new opportunities.

“Barriers to entry are low. Trucks are inexpensive right now,” he says.

Tam also says how OEMs have moved new equipment into the national fleet has benefited the used truck space, and will continue to help the market into 2025. Tam says OEMs have been building at a higher than necessary rate for most of the year but have been able to use the private fleet and vocational markets to offload those units and not overwhelm the for-hire carrier space.

Data shows new truck inventories are historically high, but Tam says those numbers are somewhat misleading. Most of those units are still in the assembly line to customer pipeline undergoing upfit or body builder assembly work and aren’t waiting to be sold.

“There aren’t a lot of trucks in speculative inventory; that hasn’t been happening in this cycle,” he says.

[RELATED: UTA roundtable shares how 'digital ecosystem' can create leads and drive sales potential]

But good signs for next year don’t make current market dynamics any better. Tam says ACT’s used truck data for 2024 tracks with what most dealers are feeling on their lots. Sales volumes are up slightly but prices are not.

Through September, Tam says used truck volumes are up 18% year to date but only 3% in the retail sector. Pricing is down 22%, but the rate at which it has been falling has slowed substantially. He says after the market’s meteoric rise in 2021, a return to normal was always going to happen, but adds, “It’s taking us longer to go down the back side than it did going up the front side.”

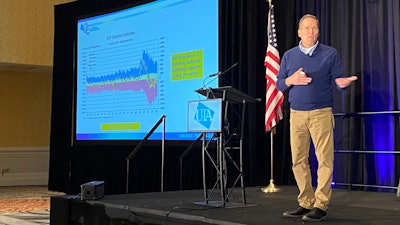

ACT Research's used truck pricing forecast for sleeper tractors, provided by Steve Tam Friday at the UTA Convention.

ACT Research's used truck pricing forecast for sleeper tractors, provided by Steve Tam Friday at the UTA Convention.

The good news is he thinks the market correction is perhaps underway.

ACT’s used truck forecast shows monthly pricing trending positive as early as December, and then rising month over month into the second half of 2026 when the pre-buy could begin driving more supply in the sector. But Tam adds that downturn is unlikely to be as long as this one, as fleets who missed out on the pre-buy will turn to the used truck market to supplement their immediate growth needs in 2027.

“If they go into the dealer and they’re told a new truck is going to be $30,000 more, they going to say ‘oh no,’” he says. “They’ll get a used truck instead.”