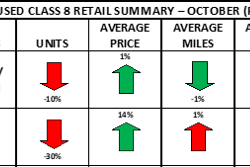

The pricing dichotomy between late-model, low-mileage trucks and all other equipment expanded in October as the used truck market continues its course correction back to historical norms, J.D. Power reported Thursday in its November 2022 Commercial Truck Guidelines industry report.

Within the auction market, J.D. Power says low-mileage trucks are still scarce and bringing strong money, while other segments are seeing prices fall toward historic trends.

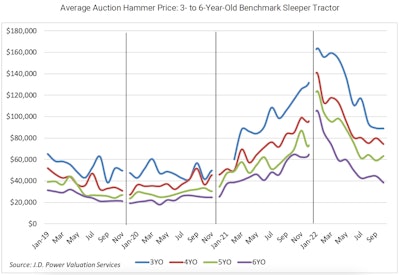

Among 2- to 6-year-old trucks, average pricing for J.D. Power's benchmark truck in October was:

- Model year (MY) 2021: (no trucks sold)

- MY 2020: $89,025; $311 (0.3 percent) lower than September

- MY 2019: $74,447; $5,555 (6.9 percent) lower than September

- MY 2018: $63,349; $4,245 (7.2 percent) higher than September

- MY 2017: $38,584; $6,075 (13.6 percent) lower than September

For the month, J.D. Power says 3- to 6-year-old trucks averaged 2.8 percent less money than September, and 20.8 percent less money than October 2021. Year over year, late-model trucks sold in the first ten months of 2022 averaged 41.6 percent more money than the same period of 2021 but, unfortunately, 3- to 6-year-old sleepers have depreciated 5.6 percent per month on average.

J.D. Power says year over year comparisons turned negative last month, but depreciation is still minimal for low-mileage trucks and moderate for average-mileage trucks. Late-model sleepers are still bringing 40-45 percent more money than the last pre-pandemic peak, the company adds.

Average auction selling price for 3- to 6-year-old sleeper tractors, adjusted for mileage.

Average auction selling price for 3- to 6-year-old sleeper tractors, adjusted for mileage.

Market dynamics should place increased downward pressure on used truck pricing in 2023, but for now, auction pricing is outperforming expectations.

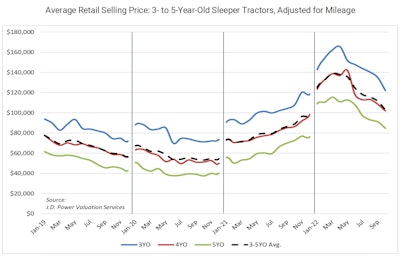

Retail used truck depreciation also accelerated for trucks with average mileage in October. J.D. Power says the value difference between individual makes and models is increasing, as is the impact of drivetrain specs.

"This dynamic is unfolding as expected in a market returning towards normality," the company says.

The average sleeper tractor retailed in October was 70 months old, had 464,349 miles and brought $95,579. Compared with September, J.D. Power says this average sleeper was one month older, had 27,589 (6.3 percent) more miles, and brought $9,368 (8.9 percent) less money. Compared with October 2021, this average sleeper was three months newer, had 14,509 (3.2 percent) more miles, and brought $12,984 (15.7 percent) more money.

J.D. Power also notes this is the first month since December 2021 to average below $100,000.

- In the large 2- to 6-year-old truck cohort, October’s average pricing was as follows:

- MY 2021: $151,905; $4,253 (2.9 percent) higher than September

- MY 2020: $122,088; $12,863 (9.5 percent) lower than September

- MY 2019: $102,000; $6,631 (6.1 percent) lower than September

- MY 2018: $84,804; $6,372 (7.0 percent) lower than September

- MY 2017: $69,940; $5,448 (8.4 percent) higher than September

[RELATED: Used truck market volume contraction continues]

The company says 3- to 5-year-old trucks brought an average of 7.7 percent less money month over month, but 15.8 percent more than October 2021. Trucks in this age group also brought 58.3 percent more money in the first 10 months of 2022 compared with the same period of 2021.

J.D. Power says depreciation is averaging 2.1 percent per month in 2022, "although that figure increases to 3.7 percent if we include only the most recent six months. Despite the ongoing correction, retail pricing for late-model trucks is still 45 percent higher than the last pre-pandemic peak."

Average retail selling price for 3- to 5-year-old sleeper tractors, adjusted for mileage.

Average retail selling price for 3- to 5-year-old sleeper tractors, adjusted for mileage.

Sales per rooftop also fell last month, slipping 0.3 units to 2.9 trucks per rooftop for the month. Factors limiting sales activity include a lack of desirable trucks to sell, increasing interest rates, and declining equity, J.D. Power reports.

Lastly in the medium-duty space, Class 3-4 cabovers benchmark group averaged $22,532 in October. This figure is $1,003 (4.3 percent) lower than September, and $490 (2.1 percent) lower than October 2021. Class 4 conventionals average pricing for was $31,877 in October, $1,681 (5.0 percent) lower than September but $2,259 (7.6 percent) higher than October 2021. Class 6 conventionals averaged $38,068 in October, $2,364 (5.8 percent) lower than September and $639 (1.7 percent) lower than October 2021.

In forecasting the final months of 2022 and the year ahead, J.D. Power says freight spot rates are at a low point while contract rates are still strong but moving downward. Truck utilization also is forecast to return close to the historical average in 2023, meaning truck demand should relax and used truck supply should increase.

On the positive side, consumers continue to spend strongly on goods, which J.D. Power says will draw down the nation’s substantial stockpile of inventories as long this behavior continues. Looking at supply, the new truck backlog is still considerable, but deliveries have been above a historically typical 20,000 per month since March.

"Delivering this volume of trucks into a correcting freight environment means we can expect more trades and depreciation going forward," the company says. "That potential pool of trades is substantial, thanks to the strong build rate of model years 2019 and 2020. Regardless, with Class 8 auction pricing still 35-40 percent above the pre-pandemic peak, it will take some time before pricing returns to historic trend."

For more information, and to read the entirety of this month’s report, please CLICK HERE.